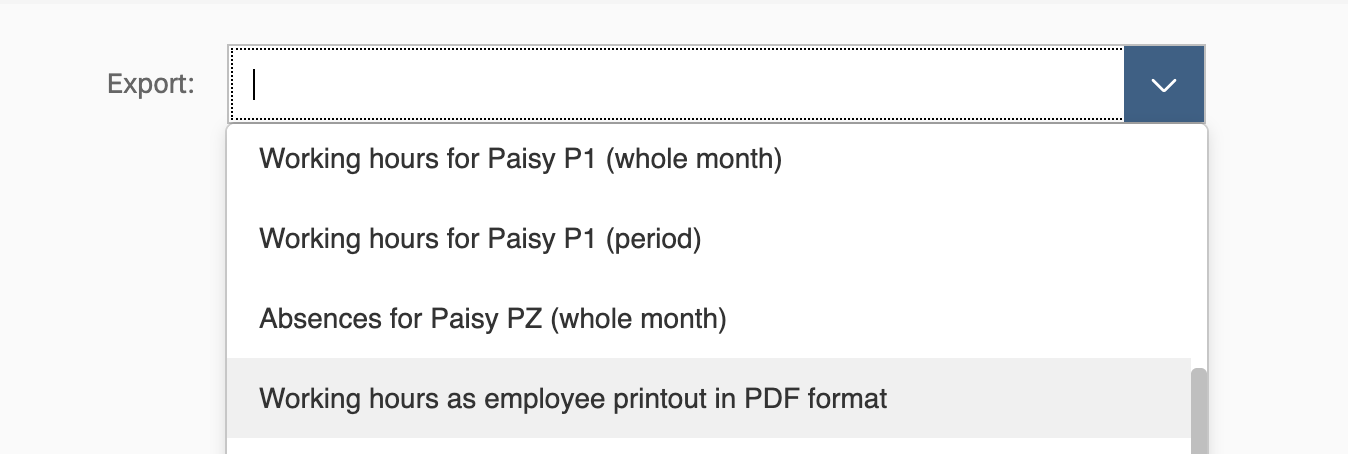

Export

Overview

The movement data recorded in Nesto (such as working hours, vacation, sick days, etc.) can be exported for payroll accounting. For this, you can select the appropriate format as well as the year and month under “Export.”

Nesto offers the following payroll exports/interfaces:

Datev Payroll and Salary (LuG)

Datev Lodas

Standard format

Recalculation format

LohnAG

Working hours

Scopevisio / Edlohn

Hours as Excel

Setting up the Payroll Export

To make collaboration with payroll accounting as easy as possible, Nesto provides interfaces to many payroll programs (e.g., Datev Lodas, Datev Payroll and Salary, Scopevisio, Agenda, Hamburger Software, and many more). To use these interfaces, they must be activated and configured by Nesto Support. During the setup process, the data to be exported is defined. This can regularly include complex cases, for example, if night surcharges for crew employees should be booked to a different wage type than night surcharges for management or loaned employees. To provide an overview, …

all available export points are listed in the “Wage Types” section; and

the corresponding filter and combination mechanisms are explained in the “Further Configuration Options” section.

Wage Types

Nesto distinguishes between the following wage types:

Surcharges:

Sunday work

Night work from 8 PM to 6 AM

Night work from 12 AM to 4 AM

Night work according to BdS collective agreement

Holiday work

Holiday work on 25th/26th Dec, May 1st, and optionally Dec 24th

Overtime surcharge

Partial shift surcharge

Flat-rate surcharge

Base:

Wage

Salary

Overtime

Other:

Benefit in kind (meals)

Clothing time

Absences:

Sick leave

Vacation

Training

Special leave

Short-time allowance

Employment ban

Maternity protection

Parental leave

Values

The wage types can be exported together with the following values:

Paid number of hours

Duration in days

Absolute payout amount

Frequency

Further Configuration Options

In the payroll export, the above wage types can be mapped to individual wage types and, if applicable, booking keys. Differentiation can be made again based on the following parameters:

Type of remuneration (wage, salary)

Surcharge amount

Contract template (e.g., BdS or non-tariff)

Employee type (Crew, Management, Trainee, Apprentice)

Minimum value

Maximum value

Shift of a loaned employee

The same wage type can be used multiple times (e.g., with different filters or different target wage types). If multiple wage types are linked to the same target wage type, the values are summed accordingly.

For the export function of working hours in Datev Lodas as well as Payroll and Salary, filtering by contract type and employee type is possible. This allows separate payroll runs for different employee groups such as management and crew.

Cost Centers

By default, the cost center of the organization unit that bears the costs for the incurred wage types is used during export. Additionally, individual suffixes can be stored in the payroll export configuration. This allows, for example, wage costs of management and crew to be booked to different cost centers.

The payroll export must be configured before the first payroll run of a location, for example, to define to which wage types the different types of times should be exported. Please establish contact between payroll accounting and Nesto Support (support@nesto-software.de) for this purpose. The payroll configuration must take place before the first payroll run. For further questions regarding configuration, please contact Nesto Support.

Working Hours as Employee Printout in PDF Format

To get a clear overview, employees’ working hours can also be exported in PDF format.

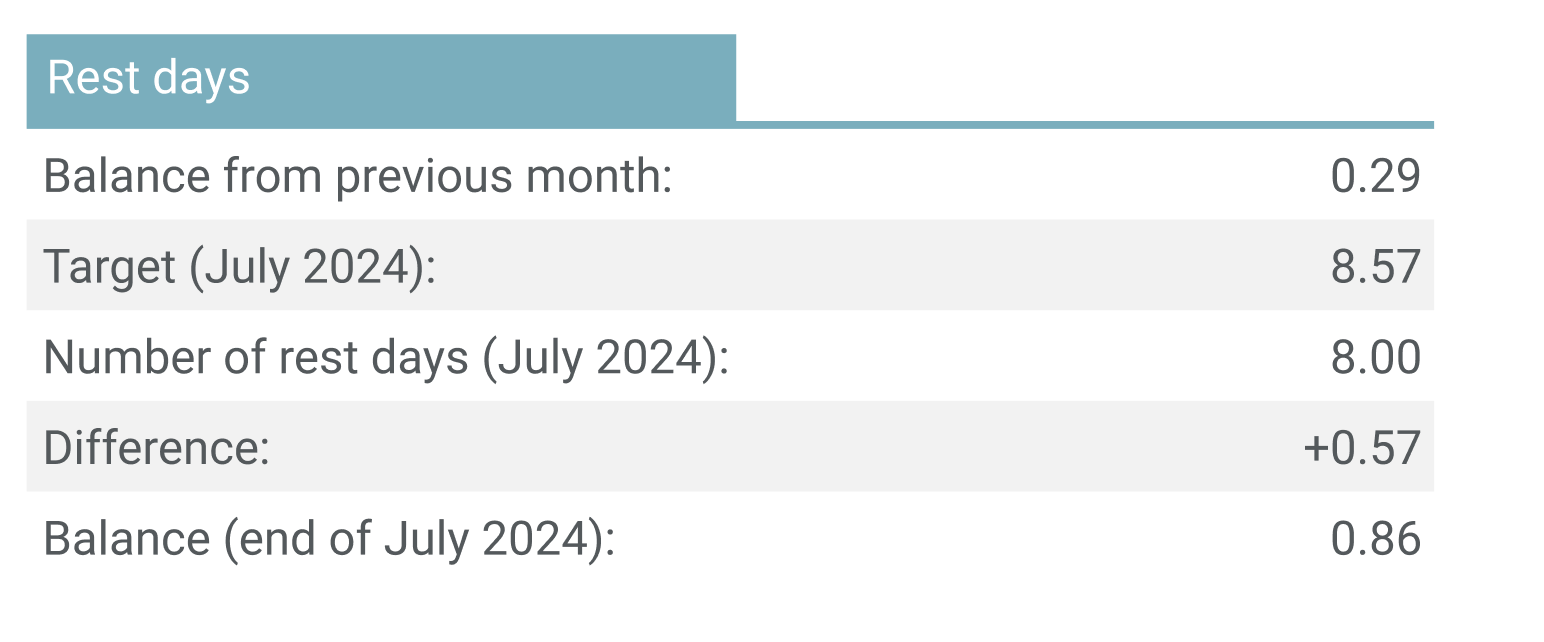

Rest Day Balance Switzerland

For Nesto customers in Switzerland, this export enables the calculation of the rest day balance. The following information is clearly displayed:

Balance from the previous month

Required days of the current month, calculated based on the number of days in the month (minus absences and considering two rest days per week)

Number of rest days taken

Current balance at the end of the month