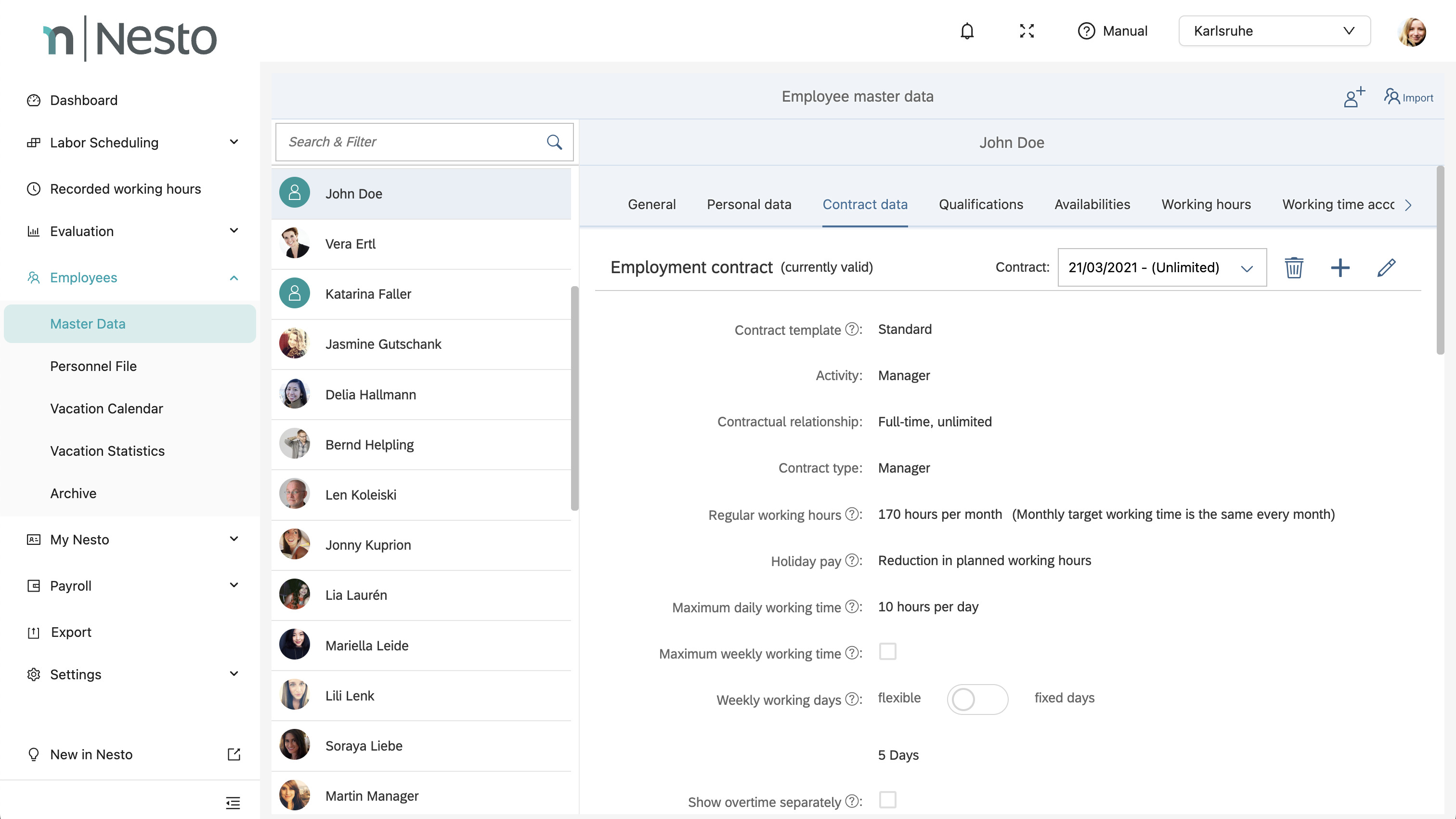

Contract data

The contract data is the "digital copy" of the written employment contract. Transfer all contract components specified in writing completely into Nesto. In the upper right part of the page, contracts can be created, displayed, deleted, and edited.

In some cases, contract data can only be changed via the payroll office.

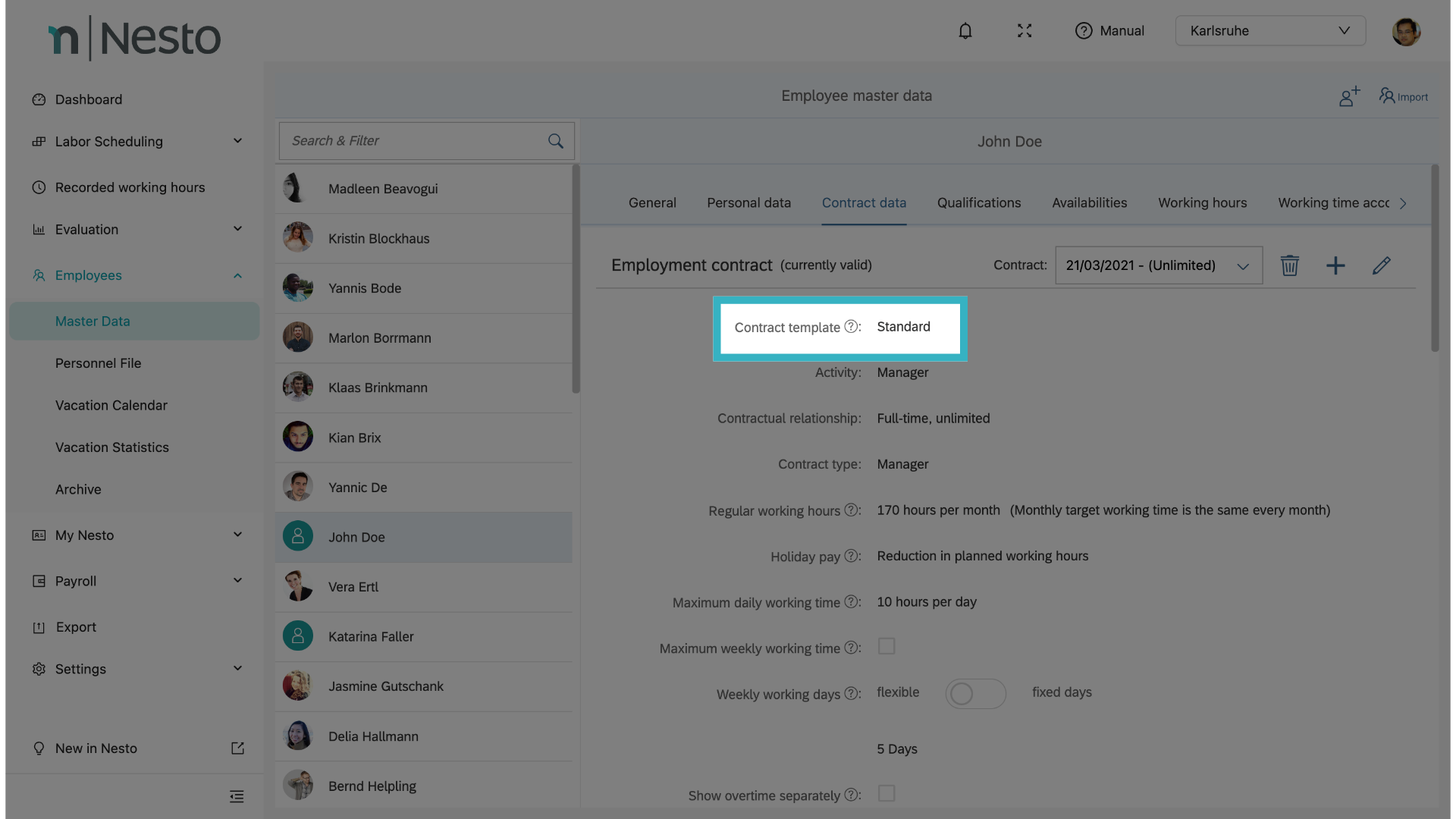

Contract Templates

A contract template is a predefined document that contains the basic structure and standardized clauses of a contract. It serves as a starting point for creating individual contracts by adding or adjusting specific information. Contract templates are often used to save time, ensure clarity, and guarantee that legal aspects are correctly considered. Under the menu item "Global Settings -> Contract Templates", templates can be created.

Here, for each contract component, you can specify whether it can be flexibly adjusted in the employee master data or set as a fixed requirement for all employees. Changes to the contract template affect either individual or all users globally. We recommend a contract template for minors that takes into account the rest periods and maximum working hours for minors.

Activity

In the employment contract, "Activity" refers to the specifically defined tasks and responsibilities that employees perform within the scope of their employment. Example: Cook (male or female)

Contract Type

In the employment contract, "Contract Type" refers to the legal relationship between employer and employee, which regulates the mutual rights and obligations during the employment period. This can be fixed-term or permanent.

Impact on automatic planning:

During automated shift assignment, full-time employees are considered first, followed by part-time employees. Marginally employed staff and student assistants are assigned last, as full- and part-time employees should preferably reach their hours.

Employee Type

The "Employee Type" in the employment relationship refers to the specific kind of employment contract concluded, which governs the conditions and modalities of employment. Example: Trainee

Regular Working Hours

"Regular Working Hours" refers to the agreed standard working time that employees are supposed to work per week or per month according to their employment contract.

The weekly regular working hours vary from month to month.

This forms the basis for calculating overtime surcharges and excess or deficit hours, which can flow into a working time account.

Impact on automatic planning:

Regular working hours also serve as the planning basis for automatic shift assignment.

Daily and Weekly Maximum Working Hours

The "daily and weekly maximum working hours" is the maximum number of hours employees are allowed to work in a day or week according to labor law regulations or the employment contract. It is used to validate planned shifts.

The weekly maximum working hours can, for example, be applied to student assistants who are not allowed to work more than 20 hours per week.

Impact on automatic planning:

During automatic shift assignment, employees are scheduled so that they do not exceed the weekly maximum working hours. Manual assignment beyond the maximum working hours is possible but the employee will be marked in red in the duty roster.

Working Days per Week

"Working days per week" are the fixed working days in a calendar week on which employees work according to their employment contract or company agreements. For flexible working days, no automatic compensation is made on public holidays. For fixed working days, the working time to be performed is reduced by that day on a public holiday.

Impact on vacation planning: The number of working days per week is related to the number of paid working days when creating a new absence. For example, if 4 flexible working days are specified, a one-week vacation will be paid for 4 days and unpaid for 3 days. This can also be manually changed by selecting paid and unpaid days.

Flat-rate Overtime Compensation

"Flat-rate overtime compensation" refers to the amount of overtime hours compensated on a flat-rate basis. For example, if 10 overtime hours are compensated flat-rate, overtime surcharges are only calculated from the eleventh hour onwards or the hours are credited to the employee's working time account.

Rest Period

"Rest period" refers to the time span between two consecutive working days during which employees are exempt from work to rest and sufficiently regenerate; these are legally regulated.

Note: Minors have longer rest periods than adults.

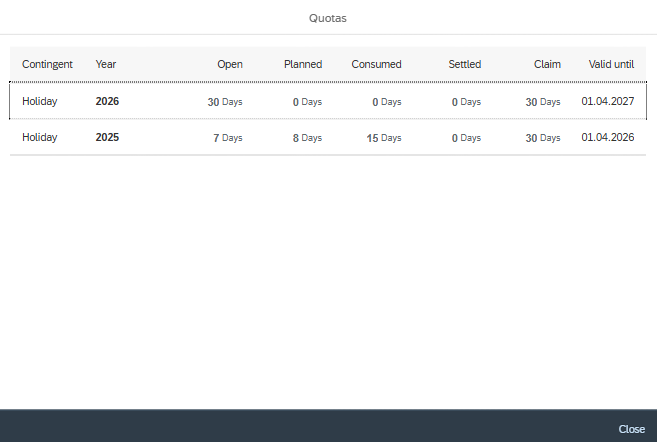

Vacation Days per Year

"Vacation days per year" are the fixed working days on which employees are released from work per year to rest and take leisure time according to contractual or legal provisions.

Note: Minors and people with disabilities may have a higher vacation entitlement.

If an employee is hired in the first half of the year and the contract duration lasts at least until the end of the year, they are entitled to the full annual vacation. The vacation entitlement for the current year can be edited by switching to edit mode in the contract data and selecting "Manage vacation entitlements".

Working Time Account

The "working time account" allows documenting recorded overtime or deficit hours of employees, which can later be compensated or paid out.

Compensation

"Compensation" refers to the financial remuneration employees receive for their work performance, either per hour or per month.

Employment Start Date

The date on which the employee is officially taken into employment and begins their professional activity.

Impact on automatic planning:

An employee can only be automatically assigned in the duty roster from this date onwards.

Employment End Date

The date on which the employment relationship ends, whether by termination, contract expiration, or other reasons.

Impact on automatic planning:

Employees can only be automatically assigned in the duty roster up to this date. Assignment beyond this date is not possible, even if the contract end date is further in the future.

Contract Signing

The day on which employer and employee formally accept the employment contract and confirm it with their signatures.

Split Shift

"Split shift" refers to shift assignment in a multi-shift operation with divided shifts, typically split into early and late shifts. If this function is activated, a "split" shift may be scheduled distributed over the day. Example: 12:00–15:00 and 18:00–23:00. If "split shift" is enabled, a split shift surcharge can be entered under surcharges.

Non-cash Benefit for Meals per Working Day

"Non-cash benefit for meals" refers to monetary advantages in the form of meals considered in the calculation of taxable income. The non-cash benefit values for meals apply to meals provided free of charge or at a reduced price to employees on working days. The non-cash benefit must be configured to be used (payroll configuration onboarding). It is calculated as a flat rate per working day. If "Non-cash benefit for meals" is enabled, it can be entered under surcharges.

Clothing Time per Working Day

Regulations regarding "clothing time per working day" may vary depending on country and labor law provisions. If set and activated, clothing time is automatically added and credited daily to the recorded working time.

Absence Compensation

"Absence compensation" is the remuneration paid per paid absence day (e.g., vacation and sick leave). For fixed weekly and monthly hours, the hours can be flat-rate calculated and entered per day. Example: 40 weekly hours (excluding break time) with 5 days/week equals 8 hours per day flat-rate absence compensation.

For employees with variable working days and/or working hours, the reference period principle can be applied. Here, average values of hours worked over the past 3 or 12 months are calculated and offset against absence compensation.

In case of sick leave according to the published duty roster, otherwise flat rate.

In case of sick leave, the hours are compensated that the employee would actually have worked according to the published duty roster. If no duty roster is published at the time of the sick notification, and in case of vacation and other paid absences, the flat rate absence compensation applies.

In case of sick leave according to the published duty roster, otherwise reference period principle (3 or 12 months)

In case of sick leave, the hours are compensated that the employee would actually have worked according to the published duty roster. If no duty roster is published at the time of the sick notification, and in case of vacation and other paid absences, the reference period principle applies.

Note: If the employee was not scheduled in the published duty roster for a day, they will not be compensated for that day.

What is the reference period principle?

It is the calculation of hours to be compensated for a day of absence. The average working hours based on the last 12 or 3 months are used for this purpose.

More details on the calculation can be found here.

In which situations can the reference period principle be useful?

Especially for part-time employees and temporary workers, the weekly working hours fluctuate. This poses a real challenge when calculating vacation entitlement. There are two solution approaches: Either the number of vacation days varies and a fixed number of hours per day is compensated, or the reference period principle is applied, varying the number of compensated hours per vacation day while fixing the number of vacation days. The reference period principle can also be applied in cases of sickness or other forms of absence.

How is the reference period principle calculated exactly?

Based on the average daily working time that an employee has worked in recent months. A period of either 3 or 12 months can be used as the reference.

The calculation of the average daily working time is always done at the beginning of a month. This means that after the calculation, the compensation remains the same for all absences throughout the entire month. Example: If an employee does not work on July 10, 2023, the period from July 1, 2022 (previous year) to June 30, 2023 (current year) is considered.

Probation Period

The “probation period” is a limited phase at the beginning of an employment relationship during which both parties can assess their suitability for collaboration. During this time, shortened notice periods often apply. Notifications can be activated under the menu item “Local Settings -> Notifications”.

Notice Period

The “notice period” is the timeframe both parties must observe before terminating the employment relationship. The exact duration varies depending on the employment contract and may also be regulated by law.

Lending Employees

Employees can be lent to other organization units; in this case, the other organization units also see the availabilities and qualifications. It must additionally be decided which organization unit bears the costs for the personnel lending. The home cost center is the organization unit that lends out the employees.

The target cost center is the organization unit that borrows the employees.

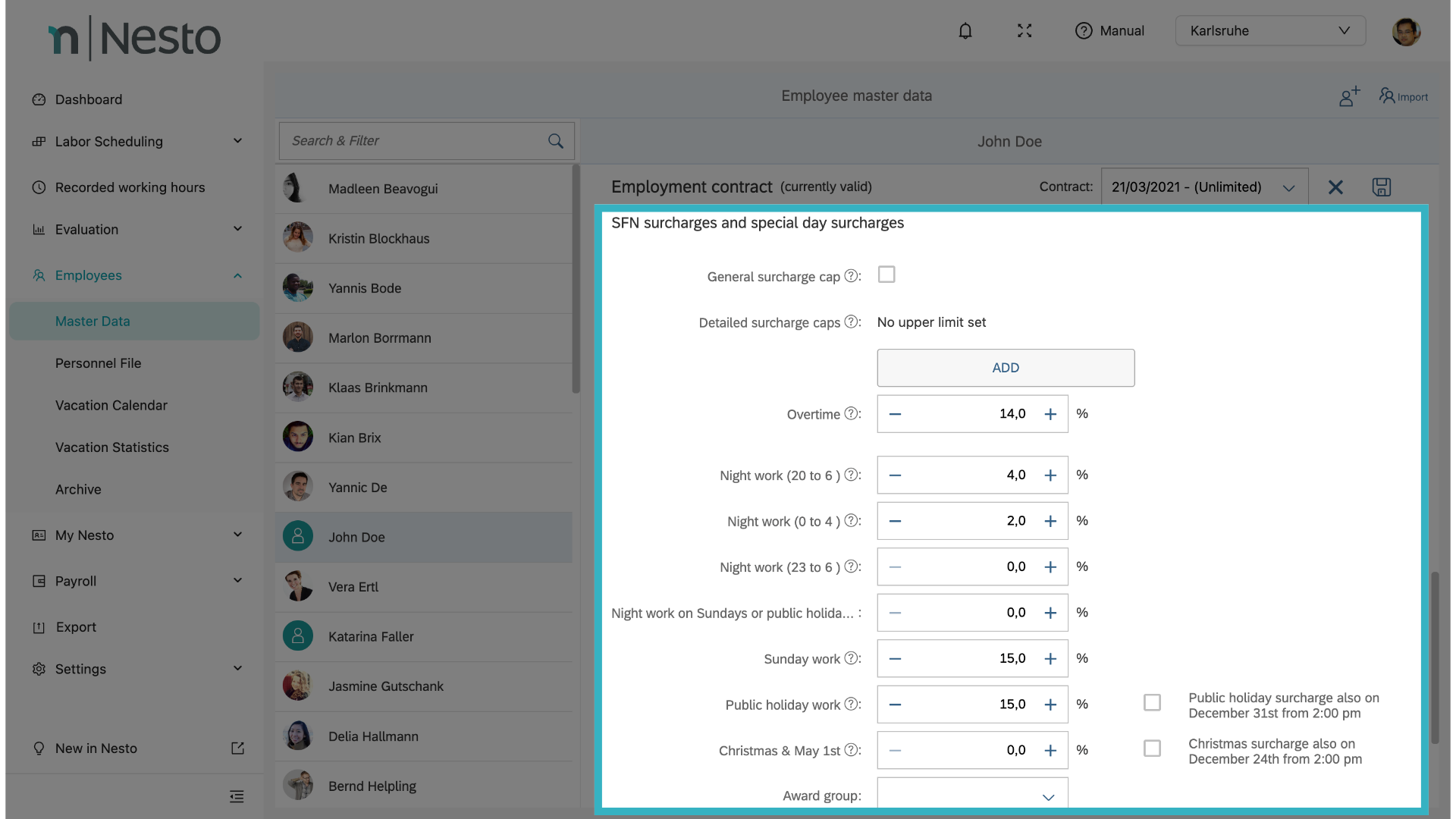

SFN Surcharges and Special Day Surcharges

SFN surcharges (Sunday, holiday, and night surcharges) as well as special day surcharges are additional compensations that employees receive for work on special days or at certain times. SFN surcharges apply to work on Sundays, holidays, and at night. Special day surcharges specifically relate to work on Sundays. The amount of surcharges varies and is often contractually or collectively agreed.

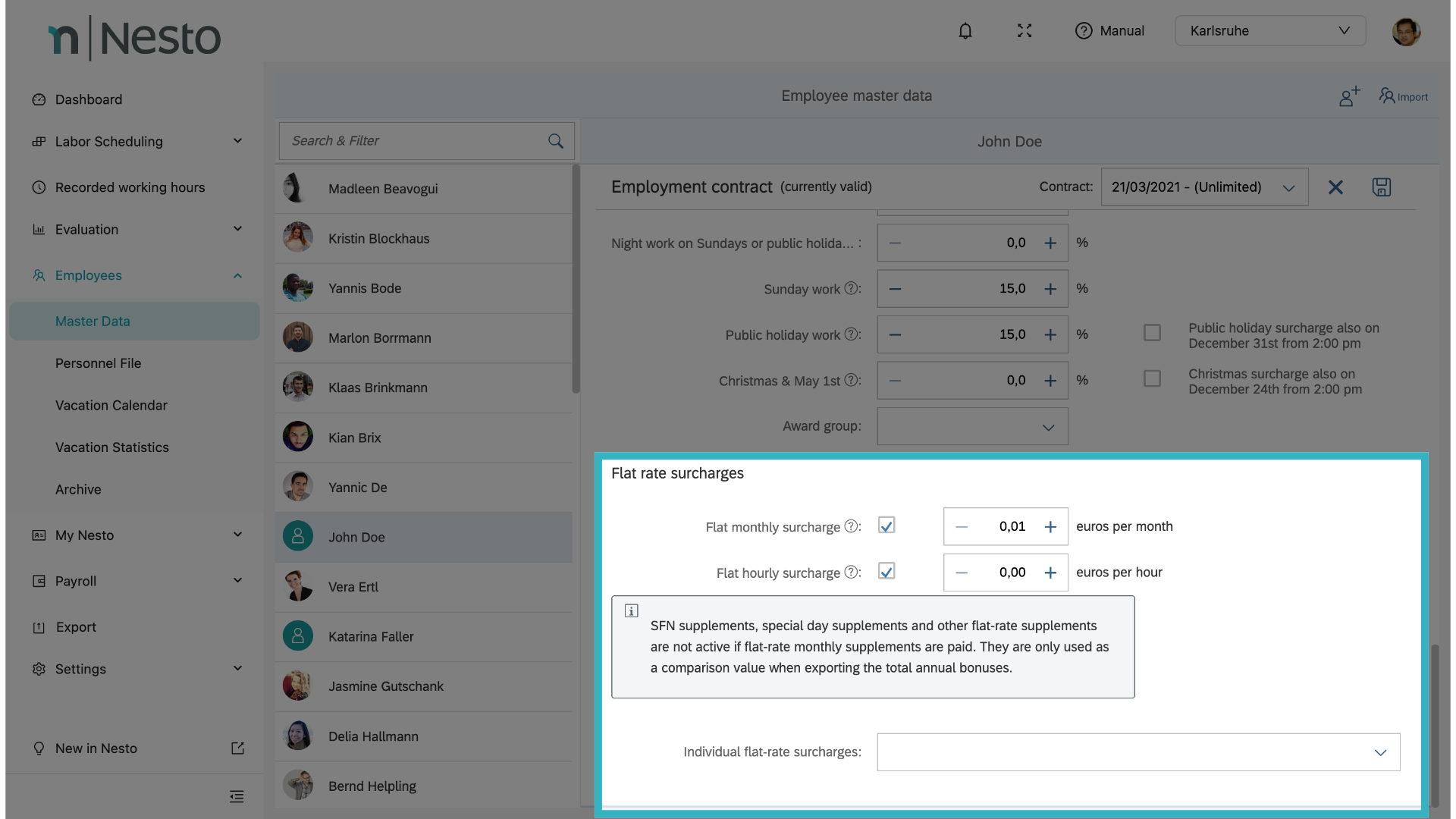

Flat Rate Surcharges

Flat rate surcharges are fixed, predetermined amounts paid in addition to regular compensation. These can apply to certain activities, working conditions, or special circumstances. Flat rate surcharges are paid regardless of individual expenses or actual hours worked.

Flat rate surcharges may be taxable, as they are generally added to the employee’s taxable income. However, the tax treatment can vary depending on the type of surcharge and the tax regulations in the respective country. It is advisable to consult a tax advisor or the local tax office for precise information relevant to the individual situation.